| Click here to go to the updated real estate tax calculator. (Now with 2008 Cheltenham Township and Montgomery County tax rates, and totals.) | Click here to go to a real estate tax calculator for all municipalites in Montgomery County. (Compare one muncipality with another.) |

Budget

2008-2009 Cheltenham School District Budget Calendar(3/4/08 - end of budget process)

| 3/4/08 | School District of Cheltenham Township notified of PA Department of Education granting of special exception of $509,052 for grandfathered (building) debt. Result is a maximum 2008 - 2009 millage or real tax rate of 37.25 mills or an approximate 5.16 percent real estate tax increase over the 2007 - 2008 rate. Note that an approximately $2,345,252 cut is needed in the 2008 - 2009 budget from the approved 2008 - 2009 Cheltenham School District Preliminary Budget below to get to the approved 2008 - 2009 millage rate. |

| 4/1/08 | Budget Presentation |

| 4/15/08 | Budget Hearing |

| 5/6/08 | Special Meeting for Preliminary Budget #2 Adoption |

| 5/21/08 | Printing and Public Inspection of Proposed Final Budget |

| 5/30/08 | Public Notice of Proposed Final Budget |

| 6/10/08 | Final Adoption of Budget |

2008-2009 Cheltenham School District Preliminary Budget (01.03.08, Adopted 01.22.08)

2007-2008 Cheltenham School District Real Estate Tax Calculator

By entering the assessed value of a property, and using the approved Cheltenham School District, Cheltenham Township, and Montgomery County, PA real estate millage or tax rates, this calculator will show an approximation of the real estate taxes from the assessed value information entered. The tax rates do not factor in any early payment discounts or rebates. The assessed value is not the same as the market value of a property. To obtain the assessed value information for a property go to Montgomery County, PA Board of Assessment Appeals property records data base and follow the instructions on that page.

(Note: Javascript must be enabled for the calculator to function.)

Enter only numeric values (no commas), using decimal points where needed.

Non-numeric values will cause errors.

2008 Montgomery County, PA Real Estate Tax Calculator

By entering the assessed value of a property, and using the approved Montgomery County, PA real estate millage or tax rates, this calculator will show an approximation of the real estate taxes from the assessed value information entered. The tax rates do not factor in any early payment discounts or rebates. The assessed value is not the same as the market value of a property. To obtain the assessed value information for a property go to Montgomery County, PA Board of Assessment Appeals property records data base and follow the instructions on that page.

Overview

The School District of Cheltenham Township produces an annual budget for each fiscal year starting July 1st. Over 70 percent of the budget goes for salaries and benefits. Most of the revenue comes from local real estate taxes, which comprise 75 percent of local real estate taxes, with Cheltenham Township and Montgomery County being the remaining 25 percent. According to The Philadelphia Inquirer, the District has one of the highest relative tax burdens in the region.

On June 12, 2007, the Board approved the School Cheltenham School District 2007-2008 budget, which included a real estate tax increase of 8.49 percent to 35.4222 mills. For a house assessed at $250,000, school taxes will be $8,855.55 or an increase of $692.80. To see the amount of the School District of Cheltenham Township real estate tax percentage increases from 2000/2001 to 2007/2008 go to the Charts page.

National Expense Ranking

According to 2005 U.S. Census data, out of 12,401 school districts nationwide that used property taxes as a revenue source, the School District of Cheltenham Township ranked 563 highest or in the 95th percentile on a per student basis. Note that each school district has different funding needs, based in part on each state's contribution to school district revenue.

Several reasons for this include the fact that the District has one of the highest value amount of land owned by non-profits (which are exempt from real estate tax, a primary funding source for the District) in Pennsylvania, a low amount of commercial real estate in the District (which tends to produce real estate tax revenue to school districts without any related expenses from the commercial properties), and a regionally low housing assessment (value) rate. Also, unfunded mandates, such as "No Child Left Behind" impose costs to the District without revenue to pay for these mandates. However, the lack of a detailed and methodical budget development and review approach, and the lack of evaluating the cost effectiveness of programs, or comparing the cost effectiveness of District programs with other school districts, impacts the District's budget.

Draft 2007-2008 School District of Cheltenham Township Budget

The 2007 - 2008 Cheltenham School District budget (link below) was approved on 6/12/07.

Suggested Budget Process For School District of Cheltenham Township

The following table states an interpretation of the current budget process and recommends a new budget process.

| Budget Process Now | Suggested Budget Process |

| Budget is drafted, with no unit cost comparisons to other districts' revenue or expenses. | Use unit cost (e.g. average daily membership or cost per student) to compare the School District of Cheltenham Township to similar districts and the entire Commonwealth to benchmark your revenue and expenses. |

| Budget numbers from the current and previous year are used as comparisons. There is no significant long-term data analysis to identify and understand trends or potential areas of concern from a program and budget viewpoint. | Review changes in revenue and expenses over time; five to ten years to identify trends and patterns and to see how they relates to other districts, and other cost indexes. |

| There is no systematic review of programs using cost benefit analysis or other worthwhile analytic tools. | Undertake a systematic review of programs in terms of successfulness at achieving goals, program delivery and cost. |

| There are only broad comparisons made to programs in other districts. | Look at and understand best program and budget practices from other districts. |

| Minor changes in the budget or programming are discussed or some pieces of programs are suggested for elimination. | Investigate potential systematic changes to deliver the same or better services at the same or lower expenses. |

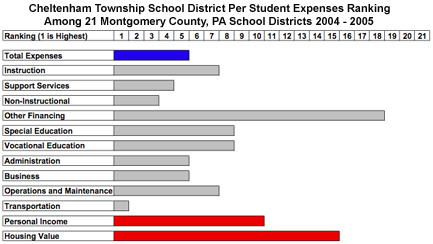

Budget Comparison to Other Districts

Each school district is unique in terms of the people it serves, its community, its ability to raise funds, and its employees, buildings and equipment. However, many school districts share similarities. These differences and similarities are worth exploring and understanding so that the School District of Cheltenham Township can have a better sense of where it stands in regards to other school districts and can learn to make changes based on these understandings. For the School District of Cheltenham Township, based on locational proximity and some similar demographic aspects, the likely best school districts for comparison are the Abington School District and the 21 school districts of Montgomery County, Pennsylvania. Also, for analytical purposes it can be beneficial to see where the School District of Cheltenham Township stands in regards to all 501 school districts in Pennsylvania.

A key tool used for the analysis is Average Daily Membership (ADM) numbers. This is simply the cost per student number so that when one school district is compared to another they are done so on a per student basis when ADM figures are used.

Page revised 03.04.08